As if by magic, corporations were rendered human by the Supreme Court’s 2010 Citizens United and 2014 Hobby Lobby decisions. They may now exercise free speech rights through unlimited political spending and enjoy freedom of religion by denying employee health care coverage for birth control pills, diaphragms, and IUDs. As Mitt Romney famously chided a heckler at the 2011 Iowa State Fair, “Corporations are people, my friend.”

But not even today’s new, improved Romney would ever suggest that corporations are people when they pay their taxes. Suggest to a conservative that these notional human beings should pay the same income tax as actual human beings, and he or she will slam into reverse and tell you, “Corporations aren’t people at all. They’re really just an inanimate pile of stock certificates that gets taxed twice, first as corporate income and then as individual shareholders’ capital gains.” This double-taxation argument is disingenuous because the people who make it usually want to eliminate taxes on both the inanimate part (corporations) and the people part (capital gains); in reality, they don’t want capital to get taxed at all.

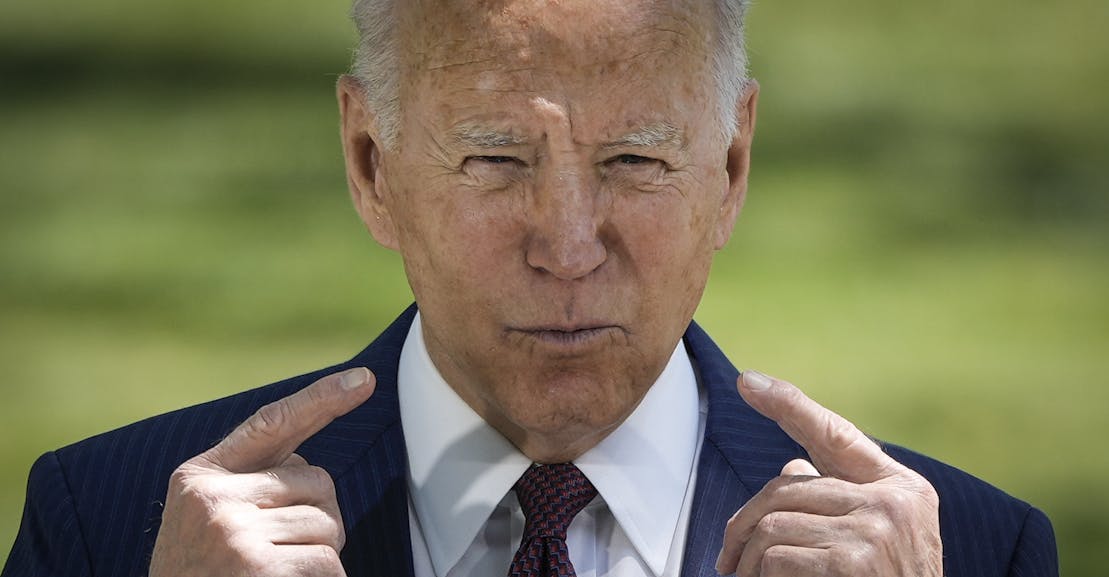

The Roberts court’s doctrine of corporate personhood is wrong. Corporations are not, in fact, people. If you prick them, they do not bleed, and if the high court were to resume barring them from pouring money into super PACs or denying contraception coverage, nobody’s rights would be infringed. It would be fun to impose sauce-for-the-goose consistency on conservatives by taxing corporations the same as we do people, but that doesn’t make much practical sense because it would put the United States out of sync with corporate tax rates in other countries. But we can certainly tax corporations more than the modest 28 percent that President Biden proposes. That’s an increase over President Donald Trump’s 21 percent, but it’s well short of the 35 percent rate that was in place before Trump slashed it in 2017. If we restored that 35 percent rate it would still be two percentage points below the top marginal income tax rate for Homo sapiens, and nearly five percentage points below the 39.6 percent top marginal income tax rate on actual (wealthy) human beings that Biden has proposed.

Comments

Post a Comment